What is KYC Verification Crypto

6 min read

Cryptocurrencies have gained significant popularity in recent years, with more and more people embracing this decentralized form of digital money. However, as the crypto market continues to grow, so do the concerns over security and legality. Enter Know Your Customer (KYC) verification, a crucial process that helps ensure compliance with regulations, prevent fraud, and protect user data.

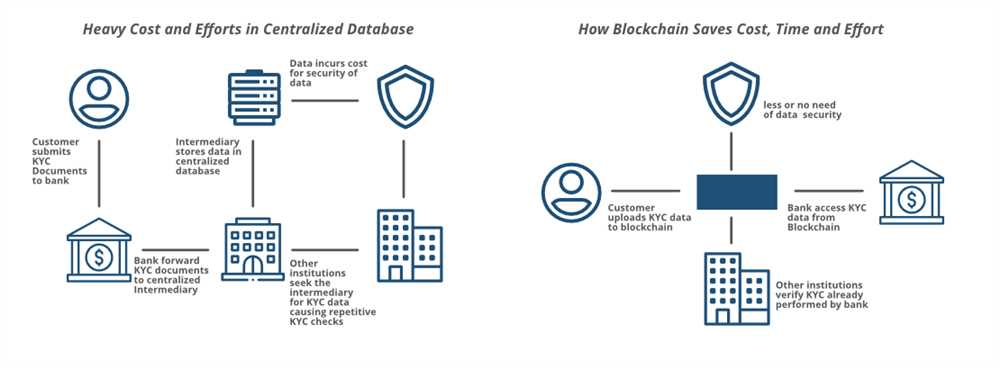

KYC verification is a standard procedure used by financial institutions, including cryptocurrency exchanges, to verify the identity of their customers. It involves collecting and verifying personal information such as name, address, date of birth, and in some cases, even a government-issued ID. The purpose of KYC is to establish a customer’s identity, assess the associated risks, and comply with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations.

By implementing KYC verification, crypto exchanges can establish a level of trust and credibility within the market. It helps prevent illicit activities, such as money laundering, terrorist financing, and fraud, by identifying and flagging suspicious transactions. Additionally, KYC verification enables exchanges to maintain transparent records and provide reliable information to law enforcement agencies when required.

While KYC verification may seem intrusive to some, it serves a vital role in protecting both the users and the crypto market as a whole. By providing a secure and regulated environment, KYC verification encourages mainstream adoption of cryptocurrencies, enabling individuals and businesses to confidently participate in this innovative financial system.

As the crypto industry continues to evolve, it is crucial for individuals to understand the importance of KYC verification and its impact on the overall security and legitimacy of the market. By complying with KYC requirements, users contribute to the establishment of a safer and more sustainable crypto ecosystem, one that is embraced by governments, regulators, and traditional financial institutions alike.

What is KYC Verification?

KYC verification, or Know Your Customer verification, is a process used by businesses and financial institutions to verify the identity of their customers or clients. It is a necessary step in compliance with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations.

The goal of KYC verification is to prevent money laundering, fraud, and other illegal activities by ensuring that customers are who they claim to be. It involves collecting and verifying personal information such as name, address, date of birth, and identification documents.

Typically, KYC verification includes several steps, such as:

- Customer Identification: Collecting basic information, such as name, address, and contact details, from the customer.

- Document Verification: Verifying the authenticity of identification documents, such as passports or driver’s licenses, provided by the customer.

- Identity Verification: Verifying the customer’s identity by comparing the information provided with external databases or credit bureaus.

- Risk Assessment: Evaluating the level of risk associated with a customer based on various factors, such as location, occupation, and transaction history.

KYC verification is important not only for regulatory compliance but also for mitigating the risk of financial crimes, such as money laundering and terrorist financing. By verifying the identity of customers, businesses can maintain a secure and trustworthy environment for their users and protect themselves from legal and reputational risks.

Why is KYC Verification Important?

KYC (Know Your Customer) verification plays a crucial role in the cryptocurrency industry. It is necessary for several reasons:

1. Compliance with regulations: KYC verification helps crypto companies ensure compliance with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations. By verifying the identity of their users, these companies can prevent illicit activities such as money laundering, fraud, and terrorist financing.

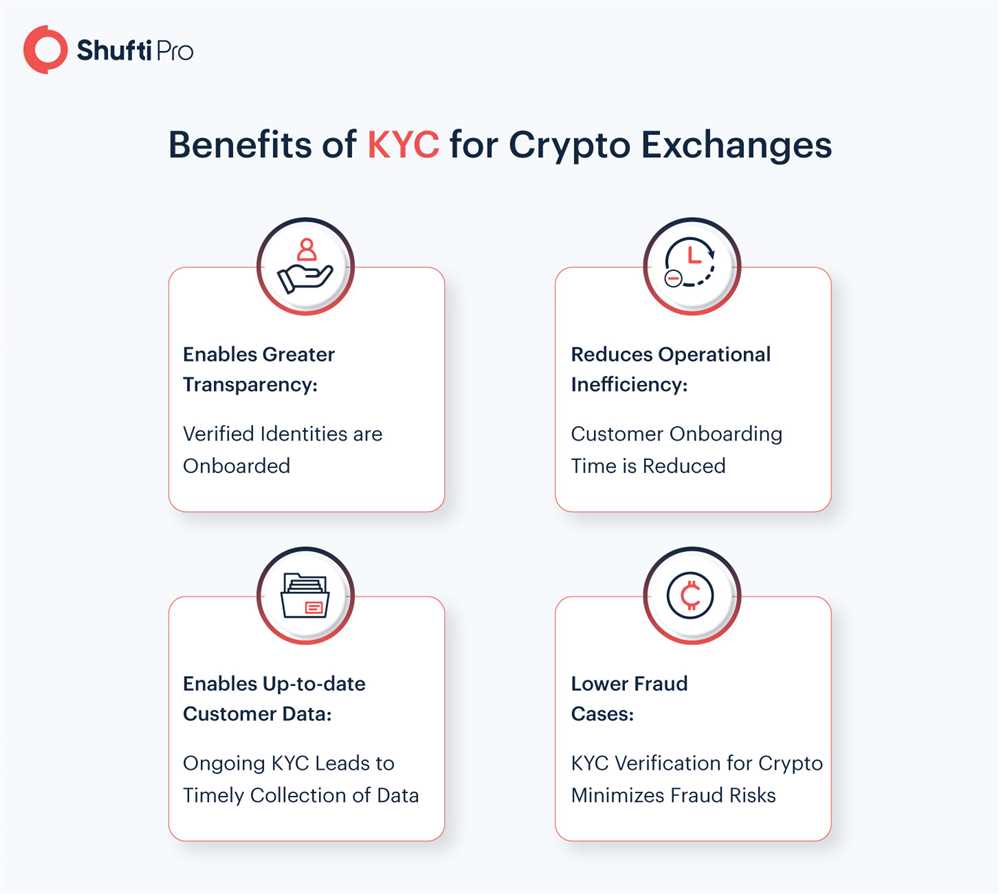

2. Protecting the ecosystem: KYC verification helps protect the integrity of the cryptocurrency ecosystem by deterring fraudulent activities. It prevents individuals from creating multiple accounts to manipulate prices, participate in pump and dump schemes, or execute other malicious actions.

3. Maintaining trust: KYC verification helps establish trust between cryptocurrency companies and their users. By verifying the identity of their users, companies can assure their customers that they are dealing with legitimate individuals and not anonymous entities. This can help attract more users to the platform and enhance overall user experience.

4. Avoiding legal repercussions: Failure to comply with KYC regulations can lead to severe legal consequences for crypto companies. Authorities can impose hefty fines or even shut down non-compliant businesses. By implementing a robust KYC verification process, companies can avoid such legal repercussions and maintain a good reputation in the industry.

5. Financial institution partnerships: Many cryptocurrency companies need to establish partnerships with traditional financial institutions to provide services such as fiat on-ramps or secure banking services. These institutions often require KYC verification as a prerequisite for collaboration.

Overall, KYC verification is important for the cryptocurrency industry to operate within legal frameworks, protect users, maintain trust, avoid legal troubles, and foster collaborations with traditional financial institutions.

The Benefits and Significance of KYC Verification in Cryptocurrencies

The rise of cryptocurrency has revolutionized the financial landscape, offering individuals a decentralized and secure way to transact and store value. However, with this newfound freedom comes the need for safeguards to prevent illicit activities such as money laundering, terrorist financing, and fraud. This is where KYC (Know Your Customer) verification plays a crucial role.

Ensuring Compliance

KYC verification helps cryptocurrency platforms and exchanges comply with regulations imposed by authorities worldwide. By verifying the identity of their users, these platforms can ensure they are not facilitating illegal activities. This compliance not only helps protect businesses from legal repercussions but also contributes to the overall legitimacy and sustainability of the cryptocurrency industry.

Enhancing Security

KYC verification provides an additional layer of security for both the platform and its users. By requiring users to verify their identity, platforms can mitigate the risk of identity theft, unauthorized access, and other security breaches. This safeguards user funds and personal information, giving individuals peace of mind when transacting in the cryptocurrency space.

Building Trust

Trust is a fundamental component of any financial system. By implementing KYC verification, cryptocurrency platforms can build trust with users and the wider community. When users know that a platform has taken measures to verify identities, they are more likely to feel confident in using the platform and believe that it is committed to operating transparently and ethically.

Furthermore, KYC verification also helps to weed out potential bad actors in the industry. By thoroughly screening users, platforms can identify and reject individuals with malicious intent, contributing to the overall integrity and reputation of the cryptocurrency ecosystem.

Facilitating AML Measures

KYC verification is a crucial component of anti-money laundering (AML) measures. By verifying the identity of users and monitoring their transactions, cryptocurrency platforms can identify suspicious activities and report them to the relevant authorities. This helps disrupt illicit financial activities and ensures that the cryptocurrency industry remains a safe and compliant space.

- Preventing Money Laundering: KYC verification allows for the identification of individuals attempting to launder money through cryptocurrency transactions.

- Combatting Terrorism Financing: KYC verification helps detect and prevent the use of cryptocurrency for financing terrorist activities.

- Deterring Fraud: KYC verification enables platforms to detect and prevent fraudulent activities, protecting both users and businesses.

In conclusion, KYC verification plays a vital role in the world of cryptocurrencies. It ensures compliance with regulations, enhances security, builds trust, and facilitates anti-money laundering measures. By implementing an effective KYC process, cryptocurrency platforms can contribute to the long-term stability and growth of the industry while protecting users and legitimate businesses.

What is KYC verification?

KYC verification, or Know Your Customer verification, is a process in which individuals provide certain personal information to a company or platform to prove their identity.

Why is KYC verification important in crypto?

KYC verification is important in the crypto industry to comply with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations. It helps prevent illegal activities and ensures the transparency and legitimacy of cryptocurrency transactions.